There’s been a lot of concern about the current state of the education system and whether it provides enough value relative to the financial requirements. There’s a growing gap between the skills learned in college and the demands of the work force, exacerbated by the amount of debt that graduates are leaving with.

It’s unlikely that the existing model for higher education is sustainable, so what are some ways we might be able to address it? Some things I’ve been thinking about.

Co-op Programs and Apprenticeships

One of my biggest regrets was not working before college. Everything I thought was important in the classroom lacked real-world context. Everything I learned was theoretical. Every decision I made was in its own vacuum of campus. I had no context of what the working world prioritized or cared about.

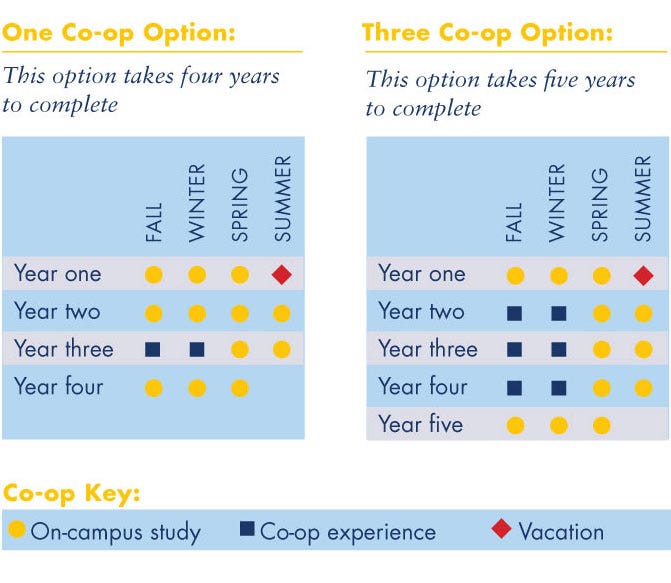

In my opinion, the working world and the classroom should be closer together so that they can complement and augment each other. One version of this that I’m a fan of is co-operative education (aka. co-op) programs. These programs intersperse working at companies with classroom experience. Drexel, for example, has two versions of this program and works with large companies like Amazon, Google, Vanguard, Boeing, DuPont, and more.

This can be a win-win-win-win situation. Companies get access to talent early on for recruiting purposes and teach skills to potential recruits to speed up on-boarding. Students get actual hands-on experience and context from the working world to then hone in on skill sets they want to develop. Universities can become more attractive choices for students. And cities get a chance to potentially secure young talent to stay in their cities after college.

I couldn’t find a ton of data about co-op programs online except for individual programs. But in Canada these programs seem to produce higher employment rates, starting incomes, and jobs related to a student’s field of study.

Apprenticeship programs are closely related to this. Employers will essentially sponsor a program for a specific skill set that combines some classroom style education with on-the-job training (starting with simple tasks and graduating to more complex ones). The big benefit here is a student actually gets paid to do these tasks.

Apprenticeship programs are common in construction and manufacturing trades (electrician, plumbing, painters, etc.) but they’re slowly also entering other fields like healthcare, IT/programming, and more. Many of these areas have a serious shortage of workers with the skill sets they need.

Apprenticeship programs should expand to more skill sets. I think the main obstacle faced is the fact that the resulting jobs tend to be stupidly viewed as lower value socially (you can apparently brag about a job where you’re a PowerPoint specialist, I say self-deprecatingly.)

Plus if you believe college is a necessity, it’s harder to pay off your debts with trade jobs. This is especially true considering the opportunity cost of time while learning the trade AFTER school.

2 Year Programs

In my opinion, one of the major ways colleges drastically over serve (and therefore overcharge) students is by structuring college into a 4 year program for nearly everyone. This is pretty arbitrary considering some people might finish what they need to know in 2 years while some might need 5 or 6.

One of the reasons this happens is because in many cases you’re taking 4 classes on completely different subjects (at least in the first couple of years). The context switching required does no one any favors either.

What if education was instead structured as multiple 2 year intensive programs? You pick a topic, learn it in 2 years by scrapping out all of the classes not associated with that topic, and move to another 2 year program if you didn’t like your first one. You could transfer whatever overlapping courses into relevant 2 year programs, and complete as many as you wanted to pay for.

This would also help people quickly figure out whether or not they like the sector they’re crash coursing. Once you’re doing something intensively, it should become immediately obviously.

Lambda School is doing something like this in computer science. How many other fields can this be replicated in?

Alternative Financing

Pricing for college is totally out of control.

In general, I think the conversations around paying for school (e.g. more scholarships) miss the point. If you increase the pool of money to pay, then the prices will go up in response. You either have to address how expensive school is by:

- Changing the underlying way pricing is done, or

- Finding alternative means of paying that aren’t just giving more money upfront

I’m more interested in the second. A couple of ways we might think about changing this.

Income Share Agreements

These have been getting more popular recently, but the idea is to take X% of future earnings instead of cash upfront. Lambda School for example takes 17% of income for two years (if you’re making $50k+).

I like this model for a few reasons. One is that it aligns institutions to help students actually finish their degrees and provide the support for them to do it. The dropout rates for students that enroll is abysmal. The promise of MOOCs and bootcamps have deflated because of poor attrition rates (I can’t even tell you how many Coursera classes I’ve started and stopped). This is probably why General Assembly, Purdue, etc. have started exploring income sharing agreements themselves.

It also then incentivizes institutions to actually make career counselors useful (aka. do more than just give general guidance like resume and cover letter writing). In particular, they should help with initial salary/equity negotiations since they can help balance the massive information asymmetry between first-time employee and employer.

A reasonable argument against this is that it then incentivizes the college to push people into high paying jobs as opposed to ones the student might have a genuine interest in. But my counterpoint would be that this happens anyway. Preprofessional tracks were really the only ones career counselors could help with and many people had to take high paying jobs to address their student debt or find themselves dealing with the interest rate accumulation.

In this model, the gap between the labor market and school could theoretically close a bit. Students should at least have the option to mix and match debt and income share agreements.

Community Service Repayment and Micro Scholarships

What if the upfront price of college was $X, but you could actually reduce it by doing certain actions while in school? This would have to be done very carefully because you risk making the measurement itself the end goal and ruining your campus culture.

One example could taking internships at non-profits or convert community service hours to tuition reduction. Med school has a lot of interesting loan forgiveness programs if you choose to go take jobs in underserved areas or institutions.

Another that I think would be interesting is giving students micro-scholarships for completing classes that tend to have high attrition rates (but yield highly valuable skill sets in the long run). For example, people would drop from the CS major as soon as they got to Data Structures because they felt it meant they were “not computer science people”.

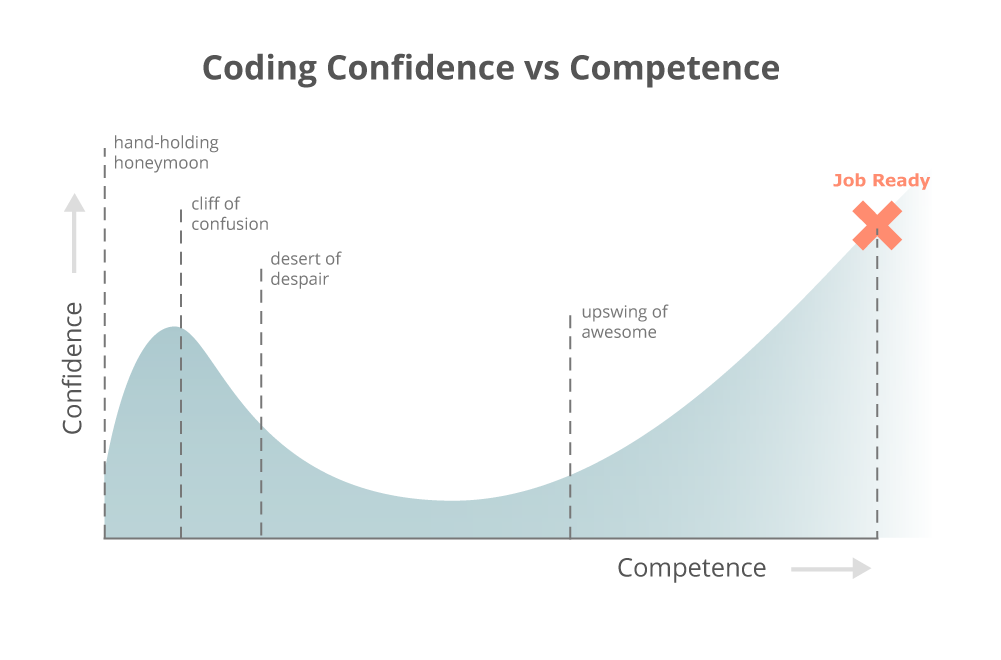

I think about the below chart a lot because it mirrors exactly how I feel about literally every skill I’ve ever learned. Dropping a skill at the desert of despair is commonplace, but what if there were monetary incentives to help you reach the upswing of awesome?

What if you got $500-$1000 micro-scholarships removed from your tuition for you to tough out these harder classes? This would likely have to be done in tandem with income-sharing agreements to make this a viable business case to the university. Or large companies could sponsor these kind of micro-scholarships for areas of high demand.

Companies setting up their own schools

I think this tweet encapsulates a big part of the college conundrum.

For students, demand for college is virtually inelastic because it’s believed that employers require degrees. This is especially true for degrees from brand name schools.

We’re starting to see inklings of reduced employer demand for college degrees in tech: several have made it no longer necessary. Apple said nearly 50% of the people it hired in 2018 did not have a four year college degree.

But as the gap between skills learned in college and employer needs grows, employers are now finding themselves in positions where they have to invest more and more in training students after college and care less about degrees. What if employers moved further upstream and got into education themselves? This would be a full closing of the gap between skills and labor in education.

For example, Amazon has a “Career Choice” program where it pays nearly all of its employees tuition if they choose a high demand field. They even host some of the classes themselves. A logical next step would be to open this up to non-Amazon employees as a means of having better access to new recruits.

This could potentially provide an alternative for people considering traditional school. If parents want their kids to go to brand name colleges so that they can get a good job, then what if an employer that already has a brand name offered their own schooling? I mean I’d probably have applied to Google University.

A big problem I would have in a model like this however is that it gives an even larger advantage to big companies sucking up and hoarding talent. But maybe those in-demand skills being taught will end up resulting in a generally bigger pool that both small and large companies can share in.

Miscellaneous Thoughts

- Standardized testing that’s both mandatory and costs money is BS. Textbooks being mandatory and not baked into the price of tuition is BS (extra BS if the professor is shilling out their own textbook and making it mandatory).

- There should be better mentorship programs to connect students 5–10 years out of college. Most students look to older students or their parents for career advice, but having someone that’s worked for a bit can give relatable and practical advice

- Having an insane amount of debt early on can alter career trajectories in a massive way. It becomes less likely that you’ll be able to take chances on high risk/high reward opportunities like small companies and makes it even more burdensome if you want to get further degrees (e.g. med school).

- One of the broader questions is whether or not school should be a time where you can freely explore areas of study beyond simply what’s demanded by labor markets. IMO there should be a balance, where you learn at least one marketable skill to make yourself valuable to potential employers while also using the time to explore non-financially driven interests.